InsurSkills – insure your skills

Insurance companies want to enable their employees to examine their own skills and their employability. This also promotes lifelong learning. InsurSkills was created for this purpose.

InsurSkills analyses 17 skills set to grow in importance in the insurance sector in the years to come. Discover your strengths and weaknesses – from a free, anonymous and independent source.

About InsurSkills

For employees

For employees

What is InsurSkills?

InsurSkills is a self-evaluation tool made up of reflective questions. It helps employees from the insurance industry to reflect on their own skills and to find out more about themselves. InsurSkills isn’t a test, exam or assessment and you can't pass or fail it.

The tool evaluates what are referred to as ‘transversal skills’. Transversal skills are abilities that can be applied to various different areas, and which are not subject-specific.

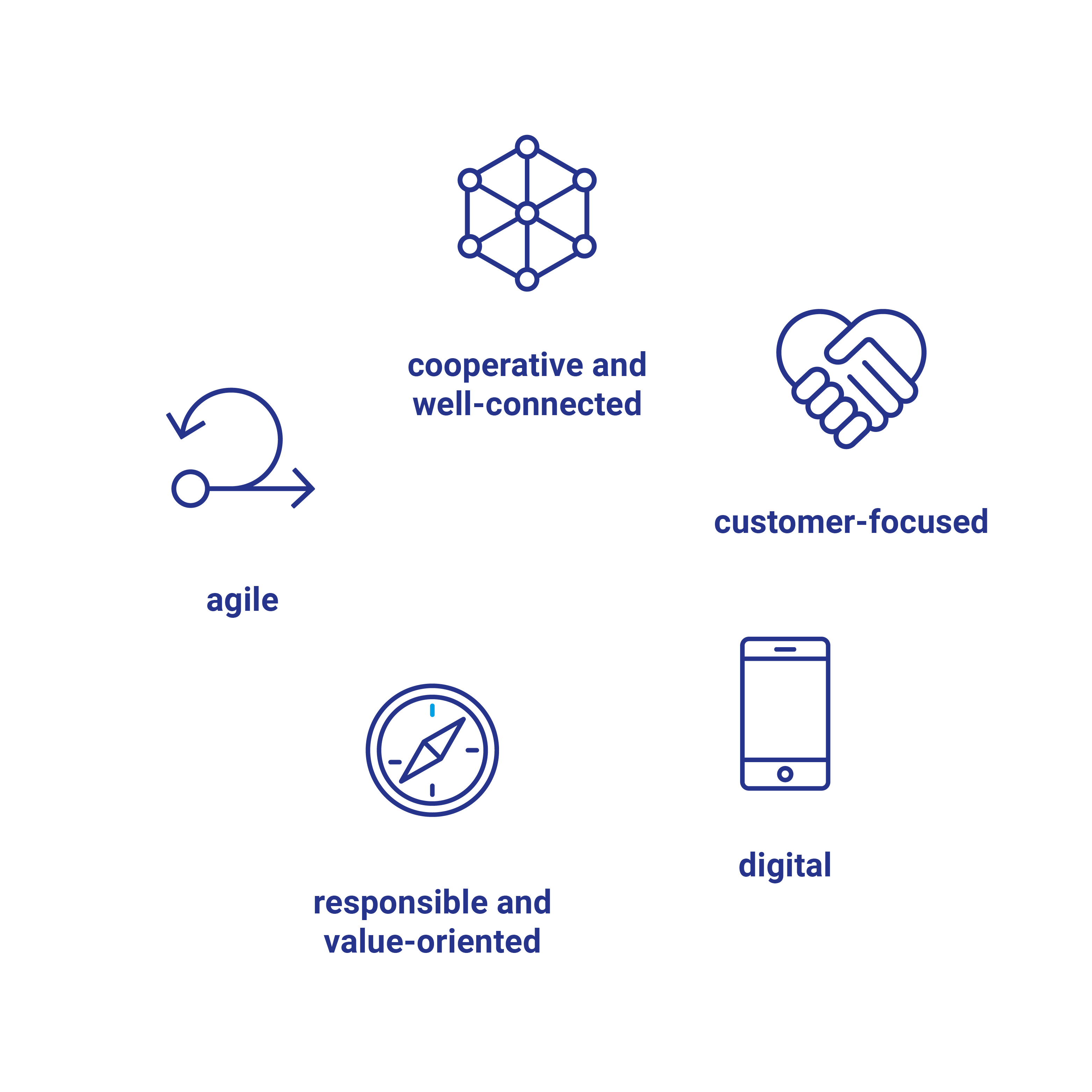

The most important transversal skills for the insurance industry can be divided into the following areas according to the study ‘Skills for the future’ for the insurance industry:

As part of the self-evaluation, questions are asked in relation to the following 17 skills:

| Personal and self-management skills | Entrepreneurial activity and decision-making skills |

|

|

| Social and organisational networking skills | Industry and digital methodological skills |

|

|

What added value does InsurSkills bring to me personally?

InsurSkills is an awareness-raising tool that can help you find out more about your skills. What are your strengths? Where is there potential for improvement? InsurSkills supplies initial answers to these questions.

Important: to obtain meaningful results, the self-evaluation must be filled in truthfully. Set aside enough time to do so.

What added value does InsurSkills bring to the company?

The self-evaluation takes place anonymously, so your employer will not find out that you have filled in the questionnaire, nor will they be aware of the results. The advantage for companies is therefore primarily raising awareness among their employees.

What can I do with the results?

In the results overview you will see where your individual strengths and weaknesses lie. Consider, even with your supervisor or HR department, which skills you would like to work on – this may be as part of internal employee programmes, further training or coaching.

Scored top results in every section? Congratulations! But ask yourself: have I answered all of the questions truthfully? Do my answers to the questions reflect my skills as they are currently? It might be worth going through the questions once more.

Are all of your results in the red zone? Could it be that you were too self-critical? It might be worth a second attempt here too. You can also request an external appraisal by somebody from your working environment (see below). If you are unsure, speak to your supervisor or the individual(s) responsible for InsurSkills within your company.

How was the reference value worked out?

In preparation for the launch of the self-evaluation tool, employees from the insurance industry received this in advance and were asked to answer the reflective questions. The reference value is the result of all the answers and indicates how employees estimated themselves on average.

Important: the reference value is not a target value that you need to reach at all costs. The skills that matter differ depending on the field of activity and position.

When and where can I do the self-evaluation?

The self-evaluation can be done online whenever you want. It can be done either on a computer or a mobile or tablet. Take at least 30 minutes to yourself to fill in the survey.

How does the external assessment work?

To gain access to the external assessment, it is important that you enter your email address at the start of the self-evaluation.

Invite your colleagues or others from your environment to assess your skills. This is an abbreviated version of the survey and takes roughly seven minutes to fill in. In order to see the results of the external assessment, it must be completed by at least three people. Your result will remain anonymous. Those invited to perform the external assessment will not see your result.

Do I need to register?

Registering with a personal email address is not required to do the self-evaluation but it is recommended.

Advantages of registering with an email address:

- You can gain access to all your results at all times.

- You will receive detailed reasoning for your results.

- You will receive a comparison of your results and can track your development.

- You can enable external assessments.

How often should self-evaluation be done?

Ideally, self-evaluation should be done regularly. This will allow you to compare how your skills have improved and where there is still room for improvement.

Who is behind InsurSkills?

InsurSkills was developed by the Swiss Insurance Association (SIA) with its member companies and Bandy Analytics GmbH. ValueQuest GmbH is responsible for the technical implementation.

How is my data processed?

The self-evaluation is performed by ValueQuest GmbH and is fully anonymous. The results are not passed on to your employer nor to third parties. The data is analysed in anonymised form and no conclusions can be drawn with regard to individual participants.

For companies:

General information

Private insurers employ 49,900 people in Switzerland. Skill shortages and demographic change are among the significant challenges that are being faced, among other things, with the concept of lifelong learning.

In order to have access to the right specialist workforce in adequate numbers in future, the SIA has teamed up with its member companies to create the study ‘Skills for the future’ for the insurance industry in collaboration with the Institute of Insurance Economics (I.VW) and the Swiss Federal Institute for Vocational Education and Training (SFIVET). The study set out to evaluate existing trends and changes in the insurance industry out to 2030 and use these insights to analyse the skills that will be required in the industry in the future.

InsurSkills was developed on the basis of this study. With this self-evaluation tool, the SIA wants to help insurance companies and their employees invest in their employability.

Further information

Additional documents:

- Factsheet for launching InsurSkills in companies

- Skills glossary

- Study ‘Skills for the future’ for the insurance industry (in german)

For more information and general questions you can contact us at insurskills svv [dot] ch (insurskills[at]svv[dot]ch).

svv [dot] ch (insurskills[at]svv[dot]ch).