BAK Study 2024: insurers remain the most productive sector in the financial industry

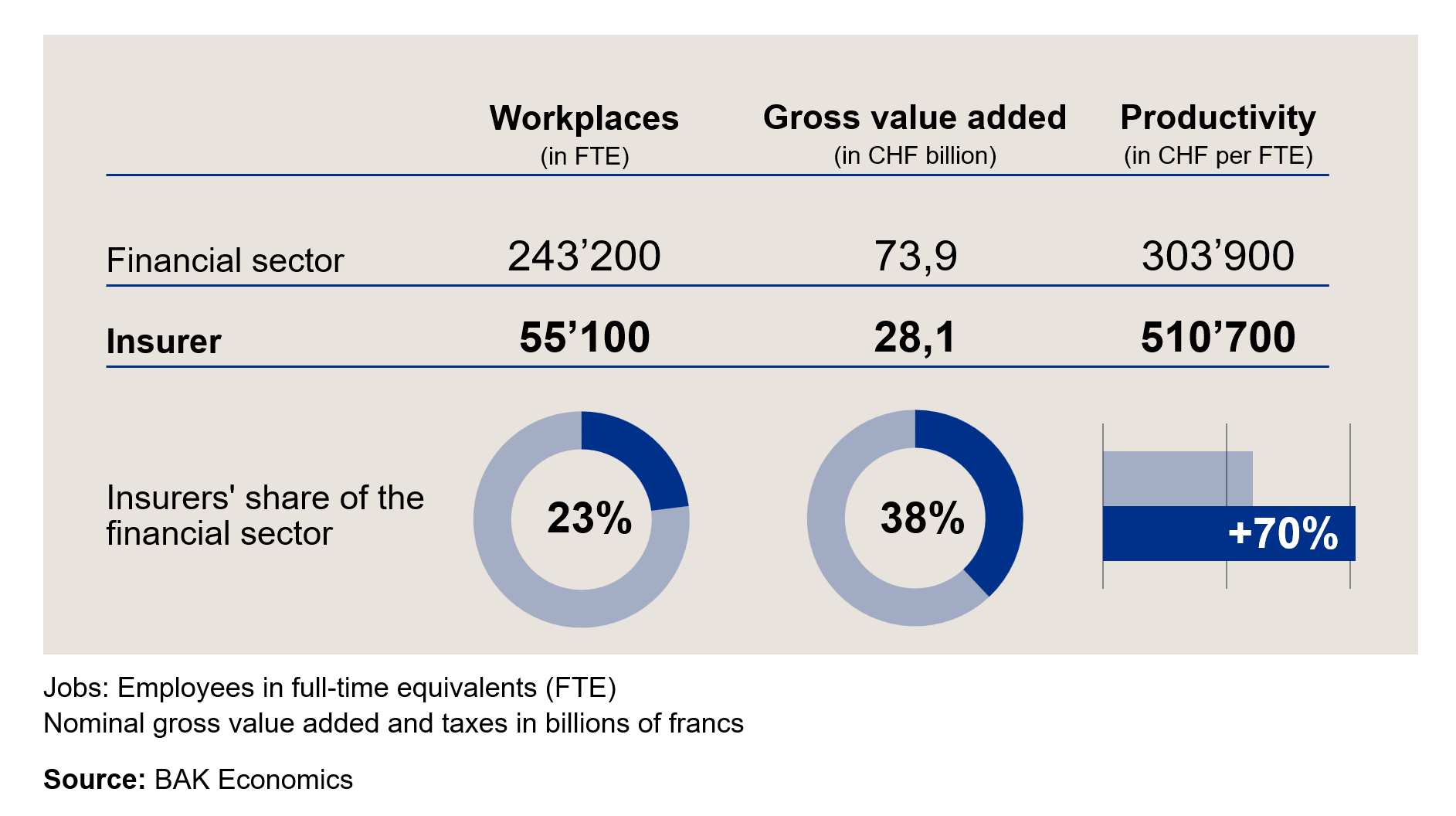

The financial sector remained one of the most important pillars of the Swiss economy in 2023. The study by BAK Economics shows that gross value added of CHF 73.9 billion was generated along the entire value chain of insurers and banks. Insurance services accounted for around 42 percent of this. With CHF 510,700 in value added per full-time job, insurers were once again the most productive industry in the financial sector.

In 2023, the 243,200 employees of insurers, banks and financial services generated gross value added of CHF 73.9 billion. This means that the financial sector directly accounted for 5.5% of jobs in Switzerland. The share of total gross value added is significantly higher at 9.4 percent - proof of the exceptionally high productivity of the sector. The insurance sector is particularly noteworthy: at CHF 510,700 per full-time job, it is almost 2.9-times as productive as the average for the economy as a whole.

With a gross value added of CHF 31.3 billion, insurance services account for around 42% of the financial sector. The majority of this (around 90%) is directly attributable to insurers, while a small proportion is also attributable to insurance-related financial services.

While the majority of life and non-life insurance is primarily focused on domestic business, reinsurers in particular operate globally. In 2023, insurance services worth around CHF 9.5 billion were therefore exported. This corresponds to 6.4 percent of total service exports.

The financial sector is also a significant source of income for the public sector. Through the direct taxation of income and profits, the federal administration, cantons and municipalities received a tax revenue of CHF 9.4 billion in 2023 – this corresponds to 9 percent of tax revenue from the taxation of individuals and legal entities. Together with CHF 9.1 billion from financial market-related taxes and a further CHF 2.2 billion in tax revenue that the financial sector indirectly triggers in other sectors, the financial sector is responsible for fiscal revenue of CHF 20.7 billion.

Fig. 1 : Insurers' share of the financial sector

Driving force for other sectors

The financial sector not only creates direct added value, but also acts as a driver for other industries: Insurers and banks generate additional orders along the entire upstream value chain through their demand for intermediate goods and services - such as IT or consulting services. Trade and commerce also benefit from the consumer spending of employees in the financial sector.

As a result of these multiplier effects, the financial sector generated additional gross value added of CHF 34.5 billion in 2023. Every franc of value added in the financial sector is therefore also linked to around 47 centimes in its industries. In total, CHF 108.4 billion - or more than one in eight francs of value added - was attributable to the activities of the financial sector.

The same also applies to the labor market: on average, one additional job was created in other sectors for every job in the financial sector. In total, 479,300 jobs are directly or indirectly related to the activities of the financial sector - of which around 151,300 are from activities of insurers.

Fig. 2: Direct and indirect economic effects of the financial sector in 2023

Dynamic outlook for the Swiss financial sector

Despite global uncertainties, weak foreign demand and the appreciation of the Swiss franc, the financial sector will continue to show stability and growth prospects in 2024. Although BAK Economics is forecasting only moderate overall economic growth of 1.4 percent for Switzerland, demand for labor is expected to remain high, which would also lead to an increase in employment (FTE) of 1.4 percent in 2024.

Insurers will continue to find themselves in a "hard market" in 2024, triggered by high claims payments in the past and economic uncertainty. As high demand meets scarce supply, BAK Economics expects insurance volumes to rise, which will have a positive impact on real gross value added both in 2024 and in the coming year 2025 (2024: +3.5%, 2025: +2.5%). Irrespective of this, stable employment growth of 1. percent is expected in 2024 and 1.0 percent in 2025.

The study on the economic importance of the Swiss financial sector, compiled by BAK Economics, is published annually in November. It is commissioned by the Swiss Insurance Association (SIA) and the Swiss Bankers Association (SBA). The focus is on the most important key figures for the financial sector, such as value added, jobs and tax revenue.